…Revolutionising Re-mortgaging

Fasttrac Solicitors was delighted to win the 2012 UK Customer Experience Award for Professional Services. The award was recognition of the fact that we have completely re-engineered and revolutionised the remortgage conveyancing process.

We literally have taken it from paper to vapour – we only require a borrowers signature on 2 documents, 99% of borrowers we serve choose to use our secure online services and borrowers love the simplicity of our technology and the excellent personal service they receive.

So What?

Good question! What is unique about what we do at Fasttrac is that borrowers, and the mortgage broker if there is one, do not choose us to carry out the legal part of the remortgage. Just think about that for a moment – they do not choose us.

We are an extension of the mortgage product chosen, part of the ‘free’ legal package offered by the lender. So we are allocated to a case and the borrower doesn’t know us from Adam!

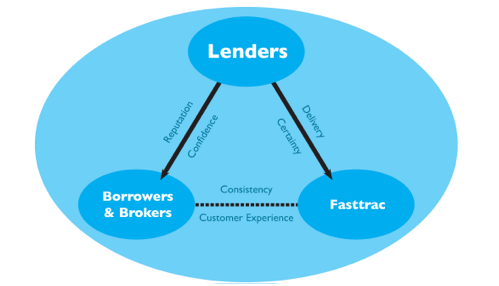

The diagram below shows how we interface with the lender directly, and how the lender interfaces with the borrower and broker directly. We complete the triangle of relationships.

This unique position has driven us to focus very clearly on providing a great customer experience – for the lender, the borrower and the broker. We have to be brilliant or else we don’t have much of a business!

What have we done?!

First and foremost we have fused process, people and technology to optimise the customer experience.

Legal processes are predicated on paper, usually mountains of it, and some of it written in technical ‘legalese’!! Not a good start point for a great customer experience.

We have removed virtually all paper form the process and the documents we have to put in front of borrowers have been simplified and re-written using plain English. Streamlining and simplifying in this way has removed traditional obstacles from the process and made the process easier to understand for the borrower.

We have automated as many tasks as possible to make the overall process more effective and efficient. For example, we have removed the need for team members to read complex legal documents by having them read by machines that look for key words. This avoids human error and the system prompts actions to be taken upon discovery of key words.

In turn this has liberated our people to be able to concentrate on serving the customer when they call or email us. We have removed the majority of ‘manual’ work from the process to allow team members to concentrate on facing the customer. This is borne out by endorsements praising the helpfulness of our team members and the high standard of telephone service.

Further, we have broken the whole process down into discreet tasks so that one person does not own a case from start to finish. Team case ownership has liberated our service proposition because every team member owns the entire customer journey – we are all part of service delivery; that isn’t somebody else’s job, it’s everyone’s!

Technology has been central to the revolution we have brought about. We have taken every opportunity to invest in technology that enables us to improve our service. We have fully automated links with Land Registry that allow us to request and receive data fully electronically, i.e. in XML format, so that we can automatically populate our systems with critical data; we use work lists throughout the whole process that ensure we never lose a case; we use team inboxes rather than individual inboxes; we use text messages and emails to communicate with borrowers and brokers; we use a secure portal where borrowers can sign in to their case and complete intuitive, online forms.

We have done a great deal more besides but I think you get the picture! The advances in technology in the last few years have been fully harnessed to drive our process forward, relentlessly. We are continually refining what we do to drive the customer experience to higher levels.

Results

We have doubled our capacity by making these changes. Our endorsement levels are in the 90%s for great service. We have reduced our carbon footprint enormously, probably in the region of 60%, due to the huge reduction in paper and postage.

The endorsements below are just a small sample of what we receive every week. We update these on our website every Friday.

“Really loved the fact that the service was conducted entirely online and with minimal requirement for hard copy documents. Was the most streamlined mortgage process I have ever experienced, and was executed with fantastic efficiency!”

“Best mortgage experience ever. Whenever I raised a question, it was answered really quickly. 10/10The people I dealt with obviously knew what they were talking about. 10/10The transaction went through very fast and very smoothly. 10/10 And the absolute top thing? The people always sounded interested and as if they were doing everything so I could get what I wanted when I wanted it. 11/10”

“Very efficient website supported by intelligent, personal and professional service. I was particularly impressed by the flexible approach demonstrated by one of your team in helping to ensure that the mortgage completed on time. Thank you for all your assistance.”

“Very straight forward and simple process with a progress/status map. Good communication and prompt alerts via the web portal and text/email. Easy to read and understand documentation, no gobbledygook. Completion date was set as early as possible in the process and the date was met. This was such a painless process compared to previous mortgage/re-mortgage experiences that I am still a bit shell shocked that it is all sorted so easily – well done Fasttrac :)”

We won the 2013 Mortgage Finance Award for Best Use of Technology – Non Lenders in December 2012 for the development of 20 or so online forms that have vastly simplified the process for the borrower. The two awards we have won for Customer Experience and Technology reflect our keen focus to fuse people, process and technology to deliver a great customer experience.

Conclusion

We have revolutionised the remortgage conveyancing process. We had to because we could not aspire to delivering a great customer experience using a heavily paper-based process. To do what we have done using paper would require huge numbers of people to achieve the seamless nature of what we have built.

It has not been an easy process but is has been hugely invigorating and rewarding. We have almost reached Nirvana – a completely paperless process. That is our ultimate goal.

As you read this you might be wondering whether you could transform your own process in the same way, or be saying to yourself that you definitely cannot do what we have done! Well, just take a couple of steps back from your business and reflect on it as a customer. Put yourself in your customers’ shoes for a minute or so. What would you want service to look like as a customer of your business? How it looks now, or different?

Anything is possible! The human race has put men on the moon and a spacecraft on Mars, which is a short 9 months distant from Earth! If we can go from paper to vapour then you can just as equally transform what you do to enhance your customer experience.

Thanks for reading this article. Now go change your working world!