Customer surveys are deployed by 94% of organisations. However, Gartner found that customer service and support (CSS) leaders believe they bring less value than other methods of voice of the customer (VoC) collection. Many CSS leaders struggle to make actionable decisions with survey data due to low response rates (23%, on average). 38% of leaders say their response rate is even in the single digits.

Surveys remain the VoC tool of choice. Simply, they are quick and low-effort to deploy, and low-cost, with some survey tools available to use for free. Unfortunately, surveys fail to capture feedback that is shared by customers beyond the answers to the questions asked. This is creating a huge gap in knowledge about customer expectations and CX.

Most current VoC feedback strategies do not include listening to unsolicited customer feedback. This untapped customer data would help to demonstrate the strategic value of customer service, and help to move the function from a cost centre to an intelligence centre. Both VoC analytics and surveys provide insight when used separately.

However, when used together to complement and supplement each other, their value increases. This is because they provide a much better representation of customer feedback. There are two key steps that CSS leaders should take in order to truly understand their customers.

1. Collect indirect and inferred feedback

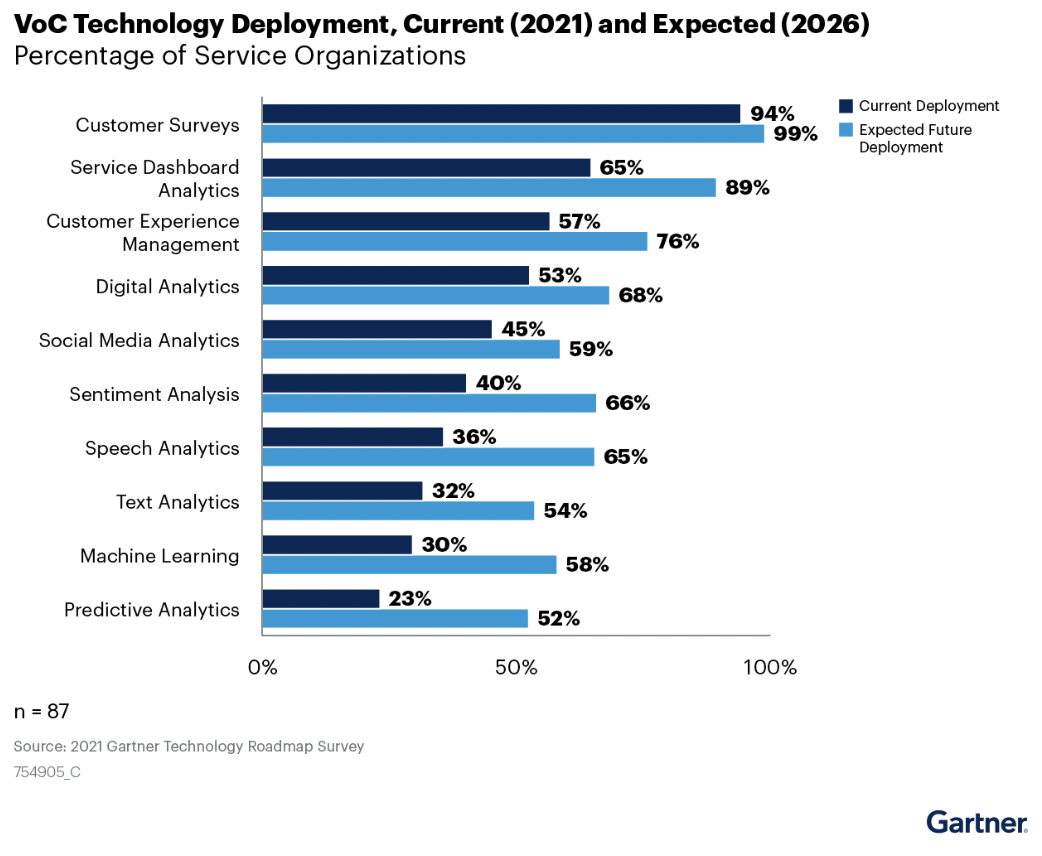

The use of indirect and inferred feedback is expected to rise in the next four years. Speech analytics are seeing the largest anticipated increase. Most VoC and analytics technologies are still being explored. Only 40% of technologies are in use by a majority of service organisations.

The percentage of technologies used is expected to dramatically change in the next three to five years. This is due to the amount of leaders investing in pilots and piloting plans for VoC and analytics.

Additionally, VoC and analytics technologies are the most lucrative investments (per CSS leaders’ expectations) in terms of overall value for the organisation. CSS leaders expect the largest increases in value over the next two years will come from digital analytics, machine learning, and sentiment analysis. CSS leaders should invest in these analytics to go beyond surveys so that they can stay competitive.

Indirect feedback

According to Gartner research, 60% of organisations with VoC programmes will supplement traditional surveys by analysing voice and text interactions with customers by 2025. CSS leaders can use speech analytics to data mine all recorded customer phone interactions. These are often full of customer comments and feedback. This technology can listen to those interactions for statements from the customer that indicate a repeat call, sentiment regarding a company policy, effort with the process and failures with digital channels.

Social media analytics and text analytics capture indirect written feedback that customers would share on the company’s community forum, a Facebook page, a chat interaction or in the free text comment field on a survey, for example. Where surveys only tell part of the story, use indirect feedback to listen to 100% of your interactions.

Inferred feedback

To complement capturing what customers are saying, CSS leaders should also capture what customers are doing. Analysing customer behaviours and actions provides insight known as inferred VoC feedback. Analysing the path that customers take on a site — along with the number of clicks, whether they go to Contact Us or abandon the site — provides inferred details. This is regarding pain points in channel design, customer need, effort or sentiment.

Incorporating indirect and inferred feedback to your VoC strategy will offer a wealth of insight, and a much more holistic view of your customer that a survey alone cannot capture.

2. Deploy repurposed surveys

VoC analytics will not completely replace surveys. Analytics on indirect and inferred feedback will arm CSS leaders with expanded and new customer data that will answer many critical questions. However, sometimes indirect and inferred data may be missing some insights.

Therefore, surveys should still have a distinct and useful purpose. They provide direct customer feedback that supplements indirect and inferred feedback when used in a repurposed, targeted way. Therefore, capturing direct feedback through a repurposed survey is very appropriate. When repurposing surveys, CSS leaders should:

Ask questions that prompt customers to provide specific answers

Only ask questions that indirect and inferred feedback cannot answer. For example, you may hear through speech analytics recorded phone interactions that customers are mentioning struggles with the membership activation process. Some keyword searches and QA target monitoring of those calls indicate that the issue may be either the time to activate the membership, or issues with clarity of instructions. The new survey should be repurposed only to ask questions that give you insight into what the issue is during that onboarding membership activation process.

Target survey deployment to a customer demographic or a specific part of the journey

Organisations should not send this repurposed survey to all customers. As in the example above, if you hear through indirect feedback using speech analytics that customers are mentioning struggles with their membership activation during the onboarding process, target that customer demographic.

Deploy surveys for short periods of time

Surveys sometimes seem to be set in autopilot mode, asking the same questions every year and getting performance baselines that may only provide limited valuable insights and promote survey fatigue. By keeping surveys dynamic, they can be changed at a moment’s notice to get answers to critical gaps in customer data. Deploy targeted surveys until you get a statistically valid sample size. This gives you confidence with the customer feedback received on the particular question or topic where you need additional insight. Deploy only as long as you need to learn the necessary insight to fill in your knowledge gap so action can be taken.

By ensuring access to direct, indirect and inferred feedback, CSS leaders can truly understand their customers and make better-informed decisions for their organisation.