Earlier this month, new regulations in retail banking and payments across the EU came into force, allowing thousands of companies that aren’t banks to gain access to financial data and payment accounts.

Many experts are predicting a digital revolution in banking, so what is changing? How quickly will it happen? And what does that really mean for consumers?

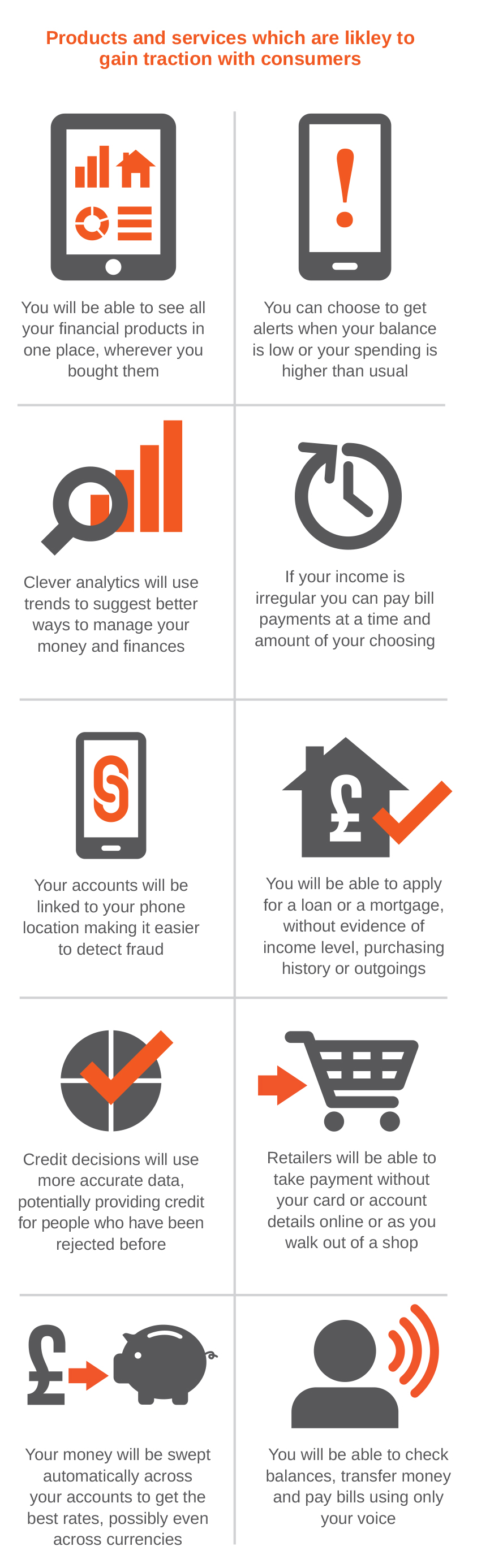

In essence, banks and other organisations such as Google, Amazon, and Facebook will provide new and innovative financial products and services. By 2020 we expect the digital transformation in banking to be in full flight, meaning consumer banking will fundamentally change.

Incumbent banks will be competing with thousands of other companies from across Europe. The large technology companies are likely to offer new ways to pay and we are already seeing new services emerge from the likes of Google. The path is also clear for much smaller, niche providers to move into consumer banking, as the regulation allows new entrants to interrogate financial data, move money and manage finances on behalf of consumers.

Whilst these new players must meet new regulations, including increased security and regulatory reporting, they won’t have the same level of regulatory scrutiny as banks.

Of course, the introduction of new regulations and the ensuing market disruption will bring with it some adverse consequences.

The risks and impacts associated with this regulatory change remain unclear. The responsibility for operational resilience, which has been at the heart of banking payment systems for generations, will be dispersed across thousands of organisations.

Large online retailers are likely to encourage customers to use online payments instead of cards to reduce their costs. If that happens, banks will see online payment volumes increase, potentially putting a strain on critical payment infrastructure.

There are also concerns across the banking community about their customers’ data security. Criminals could look to capitalise on the new open banking ecosystem to misappropriate funds and steal sensitive financial data.

All of this means that there is likely to be a period of operational instability as banks learn to manage increasingly large and unpredictable volumes, and protect their customers from new types of cyber-attack.

In summary, the new regulations mean many consumers will enjoy the benefits of new, exciting digital products and services. However, in 2018 it will be more important than ever for industry and consumers to be vigilant, by protecting their online bank account login information and personal financial data from cybercrime and fraud.