Elliot Howard of financial IT leader Sopra Banking Software explains why we need to develop a culture of ‘customer curiosity’

In 1979, innovator Michael Aldrich coined the term ‘online shopping’ – and we’ve been busy buying products and services in cyberspace ever since.

But digital culture is evolving, thanks to miniaturisation, connectedness and interface quality. This has dramatically raised customer’s expectations about what they should expect from everyone they get services from – including in the financial services sector.

Mobile devices connected 24/7, the arrival of wearable technology and increased bandwidth is giving customers access to a growing portfolio of online service. Indeed, devices are appearing that contain sensors that lets us track and control our lives via downloadable apps – what Goldman Sachs is referring to as “the third wave in the development of the Internet,” the so called Internet of Things (IoT), where everything from the office coffee pot to your Apple Watch to your husband’s fitness band is connected to the Web (and which may soon encompass a network of 28bn people and appliances all linked together).

These changes are also reflected in the wider culture. Consumers increasingly use digital to communicate with friends, family and in the workplace. For those in their teens and twenties, social media has become the default channel for the service providing businesses they spend with.

Cultivating your customer curiosity

Put all these trends together and organisations should be seeing increased opportunities for digital interactions with customers and greater convenience.

The challenge is that to hit this new digital sweet spot, businesses

need to cultivate a culture of curiosity. What does that mean? They need to prioritise the areas that work best for their customers to ensure they get a truly consistent, joined-up experience from start to finish.

Where is the value?

First, businesses need to see their organisation from the customer’s perspective – in particular, recognising that there is a need to create value through the propositions and experience provided before value can be reaped in the form of the price we charge.

Customer lifetime value and shareholder value are also closely related, but seeing the former as the principal driver requires a more oblique approach to shareholder value than banks and other companies have traditionally followed. The easiest options for efficiency gains have already been seized, so firms need to step up their game to get the next wave of them. Meanwhile, growth in shareholder value is increasingly dependent on the revenue side of the income statement rather than the cost side.

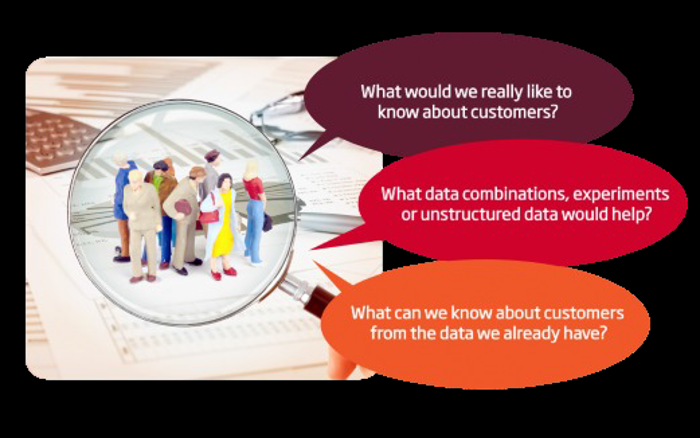

Secondly – a factor that is critical to being able to create value for customers – is the need for curiosity. Customer curiosity extends beyond the usual focus on a customer-centric approach: it means a constant focus on improving insights into customers. You need to look for the answers to why they behave as they do until it’s as well understood as the more easily identified ‘what, where, when and how’ elements of behaviour.

Up until now, the questions asked about customers are driven by the data that can be easily obtained. Yet all true advances in human understanding have come from structuring what was previously unstructured or unknown (maps being a great example with Google being at the forefront of the latest wave of geo-data enrichment but centuries of cartography stand behind it).

So customer curiosity requires a culture of experimentation, plus the recognition that some actions will sometimes be sub-optimal in strict financial terms – but the learning will more than compensate. That’s because experiments create new data and new insights – and as customer curiosity is about creating an increasingly rich data profile for each customer, whether that be with data that comes in structured form, or that needs to be structured before it can be properly analysed, you need to start on this journey sooner rather than later.

Why? Because it’s from the insights you will gain from being ‘curious’ that the next area of growth will ultimately come.

Don’t get left behind as the new digital age dawns

Customer-curious companies need to ascertain what they know today and decide what they would like to know tomorrow, then ensure that they meet the first while challenging themselves to meet the second – identifying opportunities for combining data, running experiments and structuring what is currently just noise into real insight.

The bottom line is, businesses who are not thinking about the need to become customer-curious should be, as it affects all the elements of business as we know it – from its basic competencies to infrastructure, culture, processes, IT and the way it needs to work with data to engage customers and generate customer loyalty.

Elliot Howard

Elliot Howard

Curiosity won’t kill the cat – but it will save its business!

The author is Executive Vice President and UK Managing Director at Sopra Banking Software (http://www.soprabanking.com/), a leading provider of specialist solutions for the European financial services sector

Find out more on The New Digital Age by downloading a special Sopra whitepaper, ‘Transforming Business Performance with POST-Digital Capabilities’ here