HBC has been our devoted client and award entrant since 2013 when they first entered the UK Customer Experience Awards. Later on, they also participated in the UK Financial Services Experience Awards and UK Employee Experience Awards. Their Middle East branch also entered our awards there, participating in the Gulf Sustainability and CSR Awards and the Gulf Customer Experience Awards.

LONDON — One of HSBC’s most senior technology executives says that the big bank is not far behind digital-only challenger banks when it comes to consumers offerings.

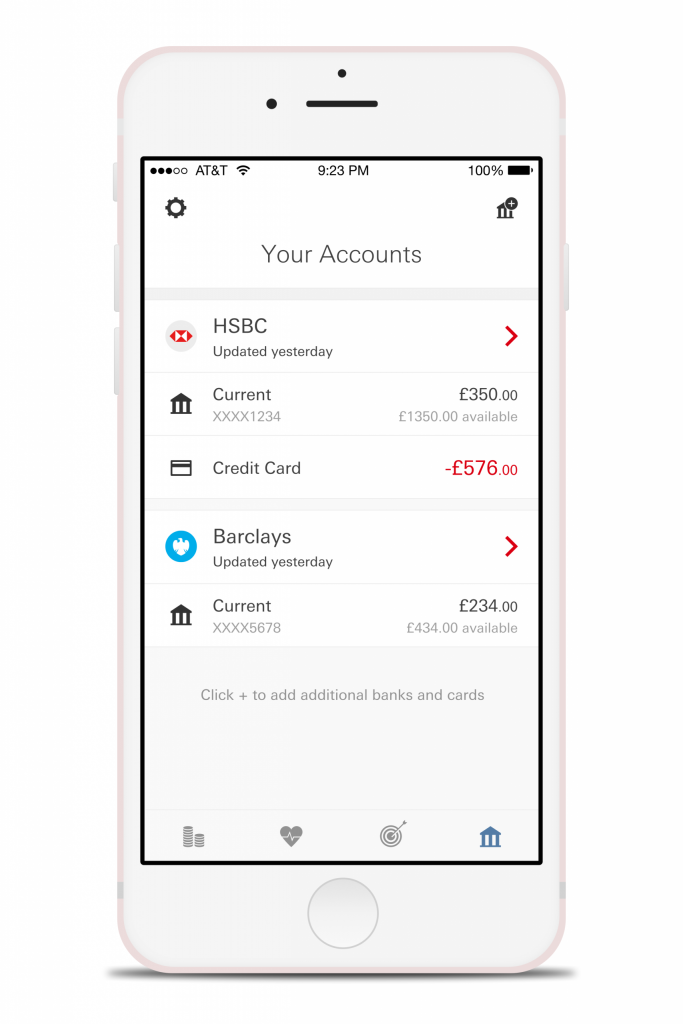

Several new digital-only banks have been set up in the UK in the last few years, including Monzo, Starling, Atom, and Tandem. These startups let customers do all their banking through mobile apps and offer smart features such as real-time transaction data showing how much customers spent and where. Collectively they have raised hundreds of millions of pounds in funding.

Raman Bhatia, HSBC’s head of digital for retail banking and wealth management in the UK and Europe, told Business Insider that while startups enjoy a technological advantage, HSBC is working hard to catch up. Bhatia said:

“In terms of what’s actually being built, I think we are in the process of actually building similar stuff ourselves. The speed to deployment, the ability to test and learn is easier on a new tech stack versus legacy but we are getting there on the agility front.”

Bhatia pointed to HSBC’s SmartSave app as an example of how the bank is keeping pace with digital rivals. The app helps people automatically put money into savings based on pre-set rules. It evolved from Nudge, an internally developed and trialled savings app HSBC worked on last year. SmartSave was trialled with around 2,000 HSBC customers in December.

“Our customers loved it,” Bhatia said. “The net promoter score was around 90%, numbers which are unheard of.”

“There are plans to make it into a proper proposition and we are working on that. The expectation is to have that available broadly for our 13 million customers and then also new customers.”

Addressing competition from digital challenger banks, Bhatia said: “I think the market is big enough for many players to co-exist. The challenges will be around driving customer acquisition and also execution. Having worked on a startup, the success of a startup comes down to your ability to execute.”

Prior to working at HSBC Bhatia was vice president at HouseTrip, an online holiday rental portal that rivals Airbnb.

‘We’re open to partnerships with fintech players’

Raman Bhatia is the head of digital, UK at HSBC. HSBC

Raman Bhatia is the head of digital, UK at HSBC. HSBC

SmartSave was developed in partnership with London fintech startup Pariti and Bhatia said HSBC was attracted to the startup because of its product and team.

Pariti offers a savings app to help people get out of debt. It was founded by Matthew Ford, formerly the head of acquisitions for personal finance app OnTrees, which MoneySuperMarket bought in 2014. Bhatia told BI:

“I think we’re open to partnerships with fintech players. The Pariti one is an example but there are others in the works.

“Down the road, the vision is very clearly as part of open banking to open source development ideas from the community at large, through hackathons [and] putting APIs in a sandbox — developing propositions for out customers with active collaboration.”

Asked if HSBC would consider acquiring Pariti given the partnership, Bhatia said: “I won’t comment on Pariti in particular but broadly we have a $200 million investment fund which is designed to find investment opportunities in fintech companies, so that option is always available to us.”

“We are active but we are very selective. We are focused on a few themes. For example, machine learning, AI, cyber security, and this whole realm of open banking-led partnerships.”

Written by: Oscar Williams-Grut

Source: Business Insider

Interesting Links:

- Startup bank Tandem names new CTO after former tech chief leaves for Dubai

- Infographic: 7 Details to Improve Customer Experience in Bank Industry

- How Salesforce CEO Marc Benioff Uses Artificial Intelligence to End Internal Politics at Meetings