This story was delivered to BI Intelligence “Payments Briefing” subscribers. To learn more and subscribe, please click here.

PayPal began piloting an instant cash-out offering for its peer-to-peer (P2P) payment offerings, including Venmo, according to TechCrunch.

The service, which is currently in a limited beta, will allow the majority of Visa or MasterCard debit cardholders to opt to cash out their wallet balance to their bank account via their debit card in real time, ranging from a few minutes to a half hour, for a 25-cent fee. Currently, transfers are free, but take up to 24 hours. The service should be arriving to all users, who can choose between the free or paid option, in the “coming weeks and months.”

This provides two core benefits to PayPal.

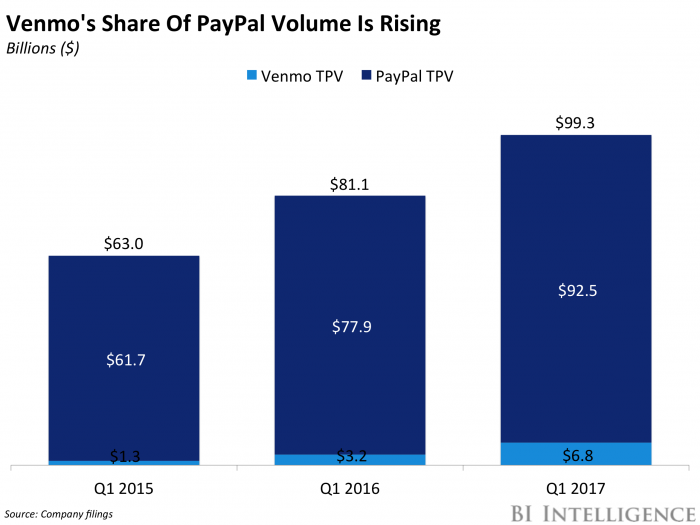

- Monetization: P2P services are some of PayPal’s fastest growing segments — Venmo grew by 114% annually in Q1 2017, compared with just 25% for PayPal overall. But they’re tough to monetize because PayPal must pay banks or issuers a fee that they can’t pass on to consumers, meaning that the firm takes the service at a loss. As P2P continues to comprise a larger share of overall volume, losses will magnify, making monetization a key priority, and one the firm is already working on through initiatives like Venmo’s buy button. The trade-off between the nominal fee and the benefits instant transfer could provide might prove popular among consumers that value convenience above all for P2P payments.

- Competitive positioning: Venmo likely is the market leader in the P2P space, where competition is heating up — a network of banks recently launched the Zelle network, which will serve up to 86 million consumers and might attract or convert a subset of users based on convenience and security. Bank-based Zelle offers free instant cash-out, and so PayPal launching a feature across its properties could help it stay up to par with what might be its largest competitor moving forward, ultimately helping it maintain its current stance.

Jaime Toplin, research analyst for BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on mobile P2P payments that:

- Forecasts the growth of the P2P market, and what portion of that will come from mobile channels, through 2021.

- Explains the factors driving that growth and details why it will come from increased usage, not increased spend per user.

- Evaluates why mobile P2P isn’t profitable for companies and details several cases of attempts to monetize.

- Assesses which of these strategies could be most successful, and what companies need to leverage to succeed in the space.

- Provides context from other markets to explain shifting trends.

You can also purchase and download the full report from the Business Insider’s research store. >> BUY THE REPORT

Written by: Jaime Toplin

Source: Business Insider

Interesting Links:

- Gate One and RHP – Improving Lives by Improving Digital Experience

- Queen’s Speech: Bill to Secure UK Space Sector

- Fintech could be bigger than ATMs, PayPal, and Bitcoin combined