- The Competition and Markets Authority has given green light to merger

- The transaction is currently expected to complete on 14 August 2017

- Merger will create Europe’s second-biggest fund manager, with £670bn

Britain’s competition watchdog has given the green light to the £11billion merger of Standard Life and Aberdeen Asset Management.

The Competition and Markets Authority has decided not to refer the merger to an in-depth ‘Phase 2 investigation’, paving the way for the deal’s completion in August.

A joint statement said: ‘Standard Life and Aberdeen note the announcement today by the CMA that it has completed its review of their proposed merger and has cleared the transaction unconditionally.’

‘The transaction is currently expected to complete on 14 August 2017, subject to remaining regulatory approvals.’

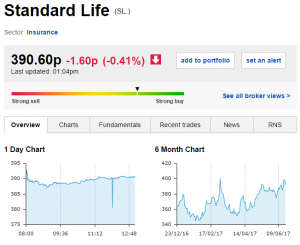

Both companies’ shares were slightly down in morning trading but this was likely due to a wider negative opening after oil prices fell further overnight.

On Monday, shareholders overwhelmingly backed the merger, with more than 95 per cent of investors at Aberdeen and 98 percent at Standard Life voting in favour of the deal during general meetings.

The enlarged company, to be called Standard Life Aberdeen, will be jointly headed up by Standard chief Keith Skeoch and Aberdeen boss Martin Gilbert.

The merger will create Europe’s second-biggest fund manager, with £670billion under management.

|

|

A memo to shareholders seen by This Is Money read: ‘It is the intention that the Combined Group will explore ways in good faith to build a successful relationship with Lloyds for the benefit of their respective customers, businesses, shareholders and other stakeholders.’

But the company declined to comment on the ‘speculation’ of a merger.

Gerry Grimstone, chairman of Standard Life, said the deal was ‘one of the most significant events’ in the history of the company.

‘There are still some approvals to be granted before the merger can complete and I know the teams in both companies are working through these diligently,’ he added.

‘We are still on track for a completion date of 14 August and will keep our shareholders informed of developments.’

Simon Troughton, chairman of Aberdeen Asset Management, said the result was a ‘landmark’ in the firm’s history.

The deal, announced in March, is targeting cost savings of £200 million a year, with around 800 jobs expected to be lost over a three-year period from a global workforce of 9,000.

Written by: CHARLIE MOORE

Source: Daily Mail

Interesting Links:

- How Customer Conversations Can Make or Break CMO Careers

- HSBC Unveils Massive Multi-billion Pound Funding Pot for London SMEs

- PayPal Has A New Weapon in The P2P Payments Battle