A return to the customer focused principles of insurance

InShared is a Dutch online general insurance company with an unusual customer focus. Only 20% of its premium income is used to fund its business operations. The remainder is used to pay claims and any left over is returned to customers. This unique proposition has made InShared the Netherlands’ premium online provider.

InShared’s launch in 2009 heralded a return to the core principles of insurance; a communal pooling of resources to share risk and provide recompense for misfortune. It committed to clear communication and scrupulously fair and transparent dealings with customers. Customer response has been positive; InShared has enjoyed double digit growth year-on-year.

InShared also understood consumers’ growing preference for dealing with finances online. From the start, it has pursued a ‘digital first’ approach that appeals to customers and supports its highly efficient business model. As Marco Ganzevles, InShared’s Customer Satisfaction Manager, explains, this financial resolve to run operations on only 20% of income drives a constant focus on efficiency. “Our customers understand that, by operating a lean online business model, we’re using their money responsibly and maximising their returns.”

For some organisations efficiency translates into compromise. Not for InShared. The company insists that efficient service is good for customers and the business.

Differently and better

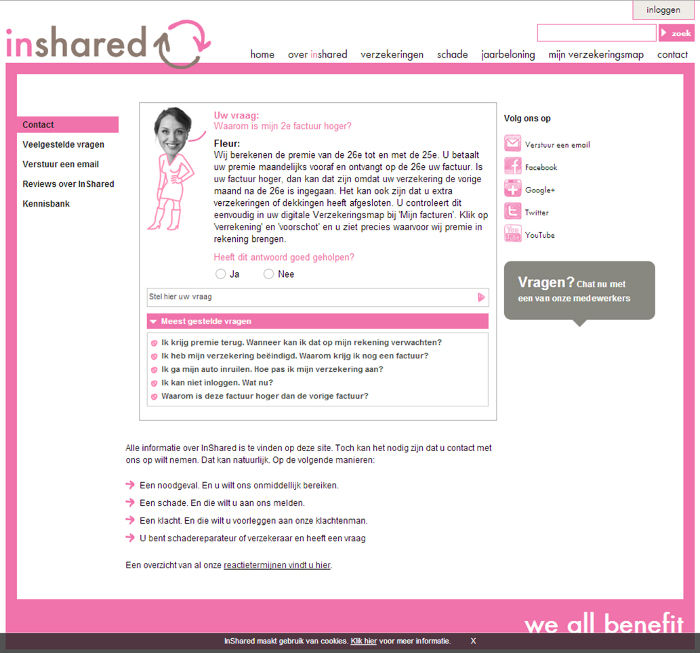

For that reason, InShared introduced a Virtual Assistant from SelfService Company to its website in April 2012. InShared understood that its ambition to allow customers to find answers to all of their questions online presented a practical challenge. “It would mean having literally hundreds of website pages. With a Virtual Assistant, we can keep our website simple.” Today, InShared’s Virtual Assistant, Fleur, has a knowledgebase of over 22,000 potential responses to customer enquiries. “No website could be that flexible,” Marco concludes.

“Customers’ positive response to Fleur was both immediate and sustained,” says Marco. Today Fleur handles over 10,000 enquiries a month – around 56% of all InShared’s non-claims customer contact. This growth has come from relentless refinements to Fleur’s library of responses. “We work tirelessly, in partnership with SelfService Company, to monitor Fleur’s performance, refine her responses and extend the range of questions she can answer.”

Customer Satisfaction with InShared’s performance, independently measured, is the highest in the Dutch insurance market at 77%. Similarly its NPS score of +7 is significantly higher than the insurance industry average, and its customer churn rate of 20% is significantly lower.

Managing demand

The intelligent analysis that SelfService Company applies to customers’ use of Fleur has allowed InShared not just to respond appropriately to questions, but to negate the need for many questions to be asked.

On each page of the website Fleur proactively displays responses to three FAQs which change depending on where the customer is on the site and what they are trying to do. “This means Fleur is able to answer our customers’ questions even before they are asked,” says Marco.

In a more recent development, Fleur has also appeared on informational emails sent to clients. For example, in October 2012 Fleur, along with a series of relevant FAQ’s started to appear on the monthly billing invoices. Billing queries received in the contact centre dropped 20% compared to the previous year.

There is no question in Marco’s mind that Fleur has made a significant contribution to reducing emails volumes and reducing its cost to serve. “Think of it this way,” he says. “Around 10,000 customers use Fleur each month. If even one in four of those sent an email instead, we would receive 2,500 extra emails a month – an increase of over 20%.”

InShared’s commitment to run its business and draw its profit from only 20% of premium income makes these financial gains particularly valuable. “The average operating cost ratio for an insurance business is far higher than ours,” says Marco. “We believe that, in time, and by refining our self-service performance, we can improve further still.”

Supporting sales

In 2013 Fleur was introduced to the online applications process for several insurance products. Early indications are positive. “Around 10% of people address questions to Fleur or use her frequently asked questions during the sales process. Usage is highest at the crucial moment when they receive a quote – eight percent of people who reach this stage then make use of Fleur.”

Looking to the future…

Ishared is already considering new developments for Fleur. “Customers are keen to ask Fleur personal questions about their policies and claims,” says Marco. “So, we are planning to integrate Fleur to our CRM system and database, She will have a 360° view of our customers and their business with us and be able to offer personalised responses based on that knowledge. Fleur continues to stretch our imagination about the possible advances of online self-service.”

For further information please contact:

Annie Garthwaite

T: 44 (0)1746 764909

E: annie@anniegarthwaite.com