Happy Friday! ‘This week in CX’ brings you the latest roundup of industry news.

This week, we’re looking at new research from Gartner on customer service transition sentiments, how female employees feel about their financial situation, and what’s been happening with Amazon in the lead up to their biggest deal sharing event – Prime Day.

There’s also comment about the effect of the hottest new social media platform to take off – Threads.

Key news

- The UK Customer Satisfaction Index was cited that Britain’s customer satisfaction has fallen at its fastest rate on record this month. It has slumped year-on-year from 78.4 to 79.9 in July (its lowest level since January 2015), costing the economy an estimated £9.8bn a year in lost time and productivity.

- With Wimbledon well under way for this year, they are trying to spark up more conversation for the sport online to engage digital consumers. It has already hit 2,000,778 total mentions. Recent collaborations with Fortnite and Roblox to attract a younger audience to tennis have only accumulated to 754 mentions combined. 76% of mentions come from audiences between 18-35 years old.

- According to Ensono, 56% of UK consumers prefer to speak to someone over the phone about their insurance. there are signs across the different age groups of a longer-term shift to digital. Amongst insurance customers aged 25-34, 38% view a mobile app as their current preferred means of communicating. Looking to the future, 45% of 45–54-year-olds think a mobile app will be their favoured way of interacting with their insurer.

- The ad share of mobile-first platforms has risen as consumers tend to use such platforms more during the summer period. TikTok’s ad share amongst UK online retailers jumped by a massive 50% from 3.78% in Q1 2023 to 5.67% in Q2 2023. This data comes from research by Juni.

- Meta’s new Threads app has broken download records over the last week, gaining more than 100m users in just 5 days. This is the fastest that a social media platform has reached this milestone – taking this crown from ChatGPT who achieved it in 2 months.

Commentary share: What Twitter vs Threads means for social commerce

Chloe Cox, Head of Social, at Wunderman Thompson Commerce

“As Meta rolls out Threads, it’s pulling no punches in its daring attempt to reel in users from Twitter. Despite its not yet fully realised functionality, Threads already boasts a staggering 100 million sign-ups in its debut week.

“And with an ultra-smooth user experience, facilitated by a swift transfer from Instagram, it’s particularly enticing to the influencer community who can transfer their audience over seamlessly. The chore of cultivating a new devoted fanbase is no longer an issue for brands, influencers and retailers alike.

“With 67% of global shoppers saying they are already shopping via social media, the potential for Threads is immense. Most intriguing is the likelihood of these figures swelling, as over half (53%) of consumers intend to hike their spending through social media. Threads, with its user-centric ethos and incredibly easy usability, is positioned to disrupt the social media space that Twitter has occupied for so long.”

Customer service channel transitions are “high-effort”

62% of customer service channel transitions are “high-effort” for customers, according to a new Gartner survey. Less than half of customers who experience a high-effort transition will use self-service again for their next interaction.

The survey highlights the benefits of promoting seamless transitions between self-service and assisted channels. Seamless transitions improve CX across a range of metrics and boost loyalty, but they also save time and resources. In fact, 93% of respondents reported high customer satisfaction (CSAT) when there was a seamless channel transition. The survey found customers who experience seamless transitions from self-service to a rep spend 27% less time on assisted channels.

In addition, customers who go on multichannel journeys with seamless transitions report less customer effort than the average customer who uses just one channel.

88% of customer journeys start in self-service touching multiple channels. Customer service and support leaders must recognise that creating seamless transitions between those service channels is the key to their digital-first service ambitions.

Gartner recommended that to create low-effort multichannel journeys, customer service and support leaders should:

- Share customers’ context from self-service with reps.

- Provide prescriptive channel guidance, not just choices.

- Make seamless transitions part of the messaging to customers as to why they should start in self-service.

UK lost one million daily users ahead of Prime Day

Amazon Prime Day may be one of the most anticipated retail events of the year. But the rapid emergence of international ecommerce rivals has led to a significant drop in users on its mobile app over the past seven months.

Consumer usage data from mobile analytics and business intelligence firm GWS reveals that Amazon’s dominance is under threat. User numbers have fallen sharply in 2023 as new rivals continue their near-meteoric rise:

- Since the start of the year Amazon has lost over 1 million daily mobile app users in the UK. In January 2023 around 9.3 million daily shoppers used its app, a figure that his since declined to 8.3 million.

- Shein has also seen impressive growth in 2023, doubling its daily users from 1 to 2 million over the past six months.

- E-commerce powerhouse eBay has also seen its fortunes turn, with daily mobile app users declining by nearly 2 million since January 2023 (from nearly 6 million at the turn of of this year to its current rate of 4.2 million).

- Vinted continues to hold steady in terms of user numbers. The company currently boasts around 2 million daily users.

Shein, eBay and Amazon all averaged just 8 minutes per user each day on their apps. Yet despite falling user numbers in the UK market, Amazon does not suffer from demographic dominance like its new international rivals. The company’s mobile app user base is more evenly split between 44% male and 56% female users. There are 90% of female users on Shein, and just 10% of men on its mobile app.

Female employees most likely to be suffering from financial stress

The rising cost of living is creating far more financial stress for female employees than their male counterparts, new research from Mintago has found.

The financial wellbeing platform surveyed a nationally representative sample of 1,333 UK adults in full- or part-time work. It found that 48% of female employees are either ‘very’ or ‘somewhat’ stressed. Less than a third (31%) of male employees said the same.

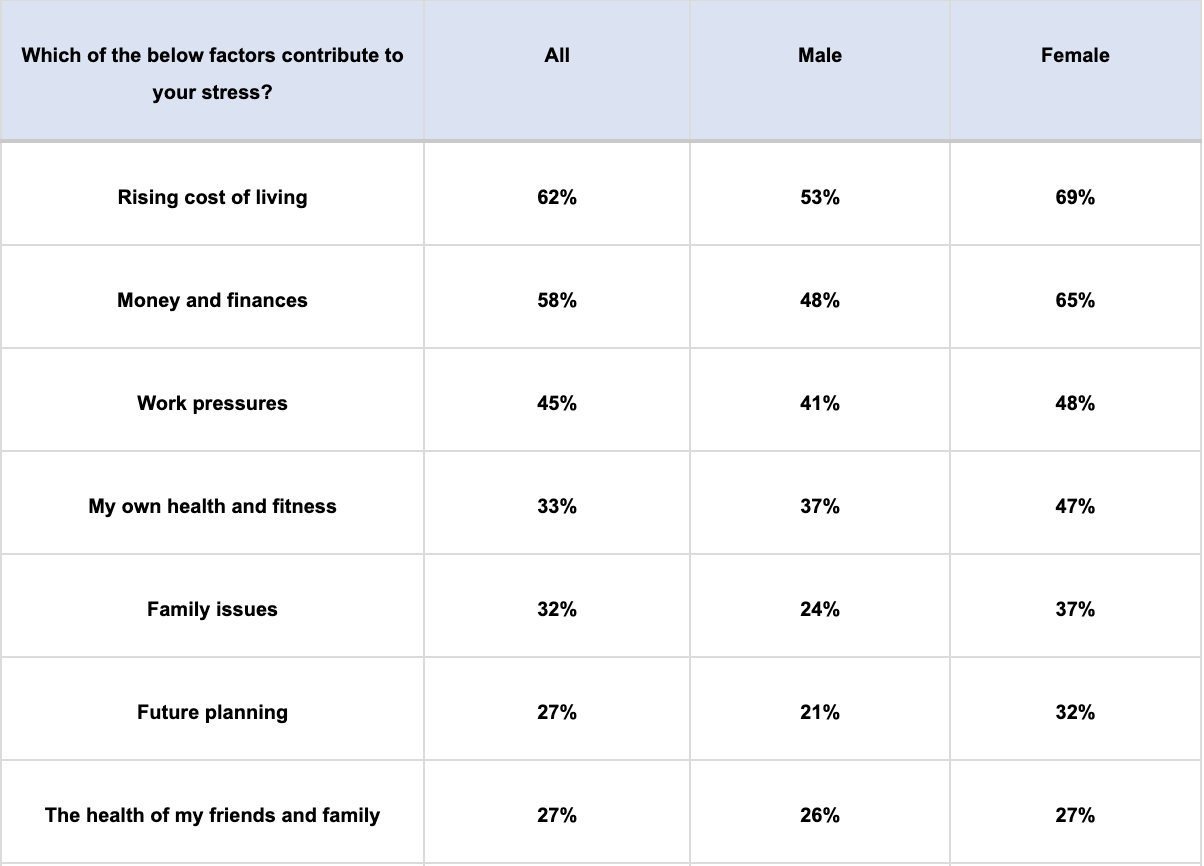

When asked about the factors that were contributing to their stress levels, 69% of female employees cited the rising cost of living is their top concern. Only 52% of male employees selected this. General money or financial worries were the second most common source of stress for both men (48%) and women (65%). Again, female employees were far more likely to have this playing on their minds.

Further down the list of stress factors, however, the survey found that men (24%) were more stressed about their job security than women (19%). In Mintago’s research, UK employees were asked to select the factors that were potentially contributing to their stress in the current climate.

Thanks for tuning into CXM’s weekly roundup of industry news. Check back next Friday for the latest updates of the week!