Happy Friday! ‘This week in CX’ brings you the latest roundup of industry news.

This week, we’re looking at the latest moves from Meta, Google’s new step to make XR tools available to all, and a new update in the cryptocurrency world.

Key news

- Data reveals that Amazon’s “Mind Reader” ad for Alexa in 2022 cost $26 million to broadcast during the live event. This makes it the most expensive commercial in NFL history. The “Mind Reader” ad showed how Alexa could make your home a little too smart. Amazon had to pay a whopping $26 million for a broadcast lasting only 1 minute 30 seconds – this is $200,000 per second of TV time.

- Microsoft is integrating OpenAI’s next generation large language model into its search engine Bing, a version that is even more powerful than ChatGPT. Microsoft will also launch a new version of its Edge browser, which will incorporate the new AI features into its sidebar. In other related news, Google unveiled Bard, its own AI chatbot, on Monday.

- CXPA London and CXPA Midlands have joined forces for a bigger and better CXPA United Kingdom! A discussion over breakfast event is taking place on the morning of Thursday 23rd February. The free networking event will be at Kantar, 6 More London Place, London SE1 2QY. It will be a relaxed but engaging way to start your day; an opportunity to connect with your peers, discuss new ideas and share experiences.

- Alida’s Winter 2023 product release is here! These new enhancements to the Alida Total Experience Management (TXM) platform will help companies make their customers feel heard, increase emotional understanding of customers, and build trust to ensure a safe space for sharing.

- Nile, a leading strategic design company, today announced the acquisition of Dig Inclusion and its flagship accessibility product, Hugr. An early pioneer of accessibility, Dig Inclusion is dedicated to making digital media inclusive for everyone. This acquisition will help Nile drive the change needed to make the online world more accessible and have a long term impact on future generations.

Freshworks has partnered with Meta!

This week, Freshworks have announced their new partnership with tech giant Meta.

Companies around the world have increased customer retention by using Freshworks’ conversational AI bots to automate communication with buyers through WhatsApp, Instagram Messaging, and Facebook Messenger. International companies like MTN Cameroon in Africa, Body & Fit in Europe and The Giving Movement in Dubai have elevated their customer support efficiency on Meta’s messaging platforms using Freshworks’ Freshchat™, Freshdesk™ and Freshsales™ products.

The Meta Business Messaging integrations with Freshworks’ CX and CRM products make customer and prospect engagement easy for support, sales, and marketing teams. With Freshworks AI-powered bots, businesses can tailor and automate messaging journeys for each channel, configure workflows across multiple channels or languages, and efficiently train bots with NLP learning capabilities.

68% of consumers say that if they can choose where to make a purchase, they are more likely to go with a business that offers convenient communication. That is why companies like The Giving Movement deliver customer engagement through Freshworks’ WhatsApp and Instagram integrations.

And here we have CXM-exclusive commentary from Prakash Ramamurthy, Chief Product Officer at Freshworks:

“A new generation of customers rule today’s world. Having grown up using messaging and social media, customers today expect businesses to respond in a way that meets their needs — in real-time at any time and through their digital channels of choice. That’s why Freshworks continues to enhance Freshchat and Freshdesk products—to help companies thrive in the world of customer service on modern messaging apps. Freshworks and Meta enable businesses to engage with their customers instantly, whether it be through self-service bots or easy routing to a live agent, to get customers the help they need.”

Customer enablement is only being emphasised by 23% of supply chain organisations, Gartner finds

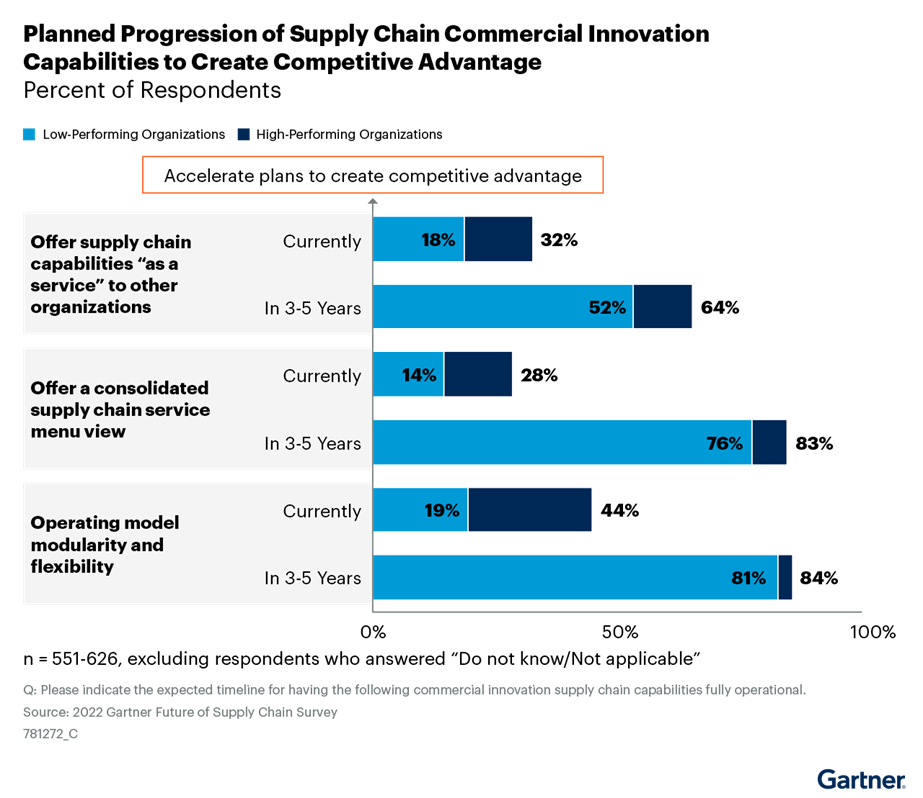

Gartner surveyed 650 supply chain leaders across geography and industry from August to October 2022 to provide a preview into supply chain strategic plans. In five years, 80% to 90% of all supply chains plan to adopt the key components of these strategies across four areas, including commercial innovation, sustainability, real-time execution and human-centric work design.

Gartner identified high-performing supply chain organisations by rating their ability to exceed expectations on eight distinct measures over the past 12 months. This includes customer experience, stakeholder expectations and business performance, among other categories.

Traditionally, supply chain leaders think of high, medium, or low value product or customer segmentations as the primary way to differentiate supply chain service. Enablement takes this further by looking at supply chain choices beyond cost, lead time and availability and differentiating experience order-to-order.

The specific strategies to achieve this are being enacted at high performing organisations at significantly higher rates today compared with their low-performing peers. These strategies will become mainstream approaches within three-to-five years.

To identify areas of cost improvement and gain more funding, supply chain organisations across the board must emphasise cost transparency. A “cost-to-serve” model can help align supply chain costs to service choices, rather than functions. This provides better transparency and increases the chances of funding new commercial innovation strategies.

Google Cloud announce the general availability of Immersive Stream for XR

Immersive Stream for XR leverages Google Cloud GPUs to host, render, and stream high-quality photorealistic experiences to millions of mobile devices around the world. The service is now generally available for Google Cloud customers.

With Immersive Stream for XR, users don’t need powerful hardware or a special application to be immersed in a 3D or AR world. Instead, they can click a link or scan a QR code and immediately be transported to extended reality. Google Maps is using it to power the “immersive view” feature in Google Maps, while automotive and retail brands are enhancing at-home shopping experiences for consumers, from virtually configuring a new vehicle to visualising new appliances in the home.

Immersive Stream for XR now supports content developed in Unreal Engine 5.0. We have also added the ability to render content in landscape mode to support tablet and desktop devices. With landscape mode and the ability to render to larger screens, there is more real estate for creating sophisticated UIs and interactions, for more full-featured immersive applications.

Home improvement retailers can let their shoppers place appliances options or furniture in renderings of their actual living spaces. Travel and hospitality companies can provide virtual tours of a hotel room or event space. Museums can offer virtual experiences where users can walk around and interact with virtual exhibits.

Users have the ability to explore far away historical landmarks without leaving their home. For example, Virtual Worlds uses photogrammetry techniques to capture historical sites, polish them with a team of designers, and then create interactive experiences on top. Because of the visual detail involved, these experiences have historically required expensive workstations with GPUs to perform the rendering, limiting their availability to physical exhibits.

Commentary: HMRC customer support measures

Routine calls to HM Revenue and Customs will be answered by text, rather than by a human, in a trial aimed at improving its customer service record. The tax authority will send a direct website link by text to some people who want to find their reference number or reset a password.

The change is part of the body’s efforts to improve its customer service record, which has historically resulted in long wait times and frustrated customers. Sam Richardson, customer engagement consultant, at Twilio, speaks about the issues customers have faced, and the different options available to businesses to overcome these issues and deliver better, more organised, customer experiences.

“HMRC is already a mature digital organisation, so applying the same thinking to their contact centre is a positive step.

“Taking advantage of interactive voice response (IVR) using natural language and programming it into their customer database would be a logical next move here. This would give three advantages: allow enhanced intent capture, enable personalised messaging and give the ability to perform simple transactions like providing account information, or changing address details, without taking staff time away from the customers that have more complex enquiries.

“There are other interventions you could implement to give people more options to solve their problems, while also significantly reducing the burden on the telephony channel – like offering appointment booking for callbacks.”

“It might seem like a small thing to add an SMS option but it’s got a big impact for stretched contact centre agents, and hopefully it will have positive knock-on effects on call wait time too.”

The Bank of England are designing ‘The Digital Pound’

Rishi Sunak has publicly pledged to turn the UK into a major Crypto hub. Last April, the PM announced the government’s intention to move towards greater legal recognition of stablecoins, in which the value is pegged to another currency or financial instrument.

The move to create a Central Bank Digital Currency (CBDC) comes with the decline of cash. The need for a publicly-backed digital currency would sit in wallets on smartphones, and could be used for shopping, much like we are used to nowadays. Monzo and Revolut would supposedly become partners in the launch.

A potential setback of the “Digital Pound” is that it could increase financial instability. This is if households and companies all withdrew money from commercial banks at once to put in a government-backed crypto. The UK Treasury said it would initially place a limit on the amounts that could be held in the new wallets. 40% of the surveyed Britons who own cryptocurrency have income over £200,000, and 18% of them with income ranging from £100,000 to £200,000.

Thanks for tuning into CXM’s weekly roundup of industry news. Check back next Friday for the latest updates of the week!