Author: Paul Ainsworth

Facing the Future of Employment: Genesys’ Cameron Smith Talks Employee Experience Tech

As innovation in CX technology continues to reshape how brands interact with customers, the tech leaders behind this growth are also envisioning and creating the workplaces of the future. At Genesys, global leaders in omnichannel CX and call centre tech such...

Two-Thirds of all Brands’ Online Content ‘Unseen’ by Customers

Over two thirds of all web content published by brands still goes ‘unseen’ by consumers, according to new research. A global study from digital experience analytics firm Contentsquare found that of all the sectors analysed, banking has the highest amount of...

2020 UK Complaint Handling Awards: Meet the Winners

The 2020 UK Complaint Handling Awards have taken place in London, celebrating the people, companies, and initiatives behind some of the best customer service operations in Britain. Hosted by Awards International – holders of an Independent Awards Standards Council Gold Trust Mark...

Forbes Business Council Honour for CX Consultant Naeem Arif

Midlands-based CX consultant and author Naeem Arif has been accepted into the Forbes Business Council, a growth and networking organisation for successful business owners and leaders worldwide. The founder of NA Consulting and Director of United Carpets, Naeem was vetted and selected by...

ContactEngine Named in Financial Times 1000 Ranking

UK Customer Experience Award winner ContactEngine has been named as one of Europe’s fastest-growing companies in The Financial Times 1000 ranking. The rating is the result of a joint project by the Financial Times and Statista, which – now in its fourth...

Building CX Muscle in Brussels: How a new Network is Boosting Customer Centricity in Belgium and Beyond

Customer Experience in the heart of Europe is advancing in leaps and bounds thanks to the passion of a growing network based in Belgium. CX Brussels was founded by Jonathan Daniels and Hannah Centeno, with the ambition of building a strong CX professional...

Civica Partners 2020 UK Complaint Handling Awards

Global digital solutions provider Civica has been revealed as a Gold sponsor for the upcoming 2020 UK Complaint Handling Awards. Civica provides a wide range of solutions for the public sector and regulated private sector markets around the world. In the...

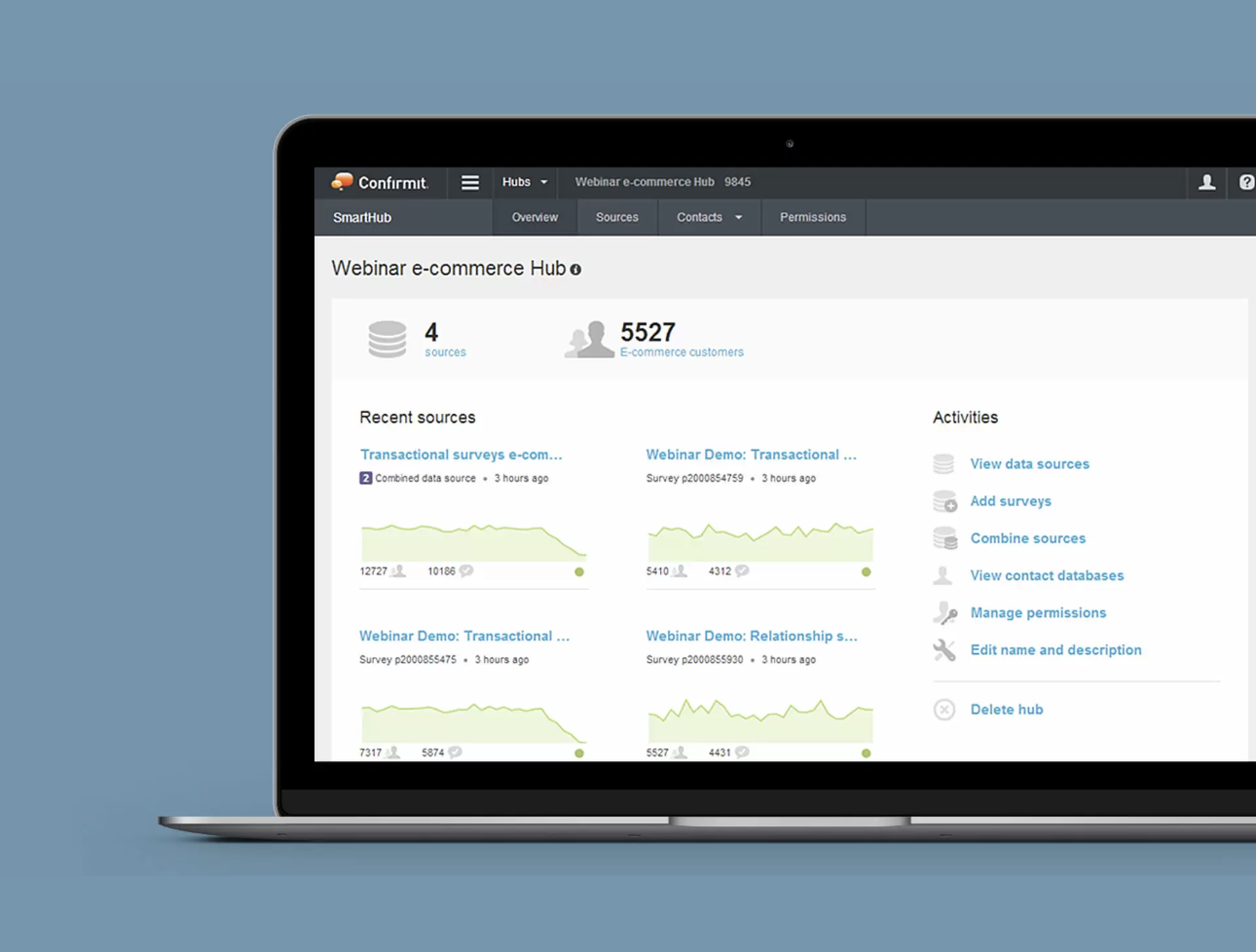

Confirmit Acquired by Verdane Ahead of Dapresy Merger

Global CX and market research solutions provider Confirmit is set to merge with data visualisation reporting firm Dapresy following Confirmit’s acquisition by North European specialist growth equity investor Verdane. The major investor in Dapresy, Verdane will merge the two companies to create a combination of solutions that “will be...

Gulf Customer Experience Awards 2020: Dreams Come True in Dubai

The very best in CX innovation across the Middle East has been celebrated at the annual Gulf Customer Experience Awards. HSBC, Ejadah Asset Management Group, and the Ras Al Khaimah Economic Zone (RAKEZ) were among the big winners on a day...

UK Employee Experience Awards 2020: Meet the Finalists

Britain’s most employee-centric firms are preparing to present in London this May, following the announcement of finalists for the 2020 UK Employee Experience Awards. Aspen Healthcare, Sky Betting & Gaming, University of Lincoln, and Harrods are just some of the names...